The Evolution and Expansion of Digital Assets

“Digital assets” has evolved from simple digital files to encompass blockchain-based assets, including digital stores of value like Bitcoin, decentralised Web3 assets like Ethereum, and digitised payment assets like Litecoin, all of which are driving the rapid digitisation of the global economy.

In the mid-1990s, the term “digital assets” was coined to refer to items like audio, video, images, and documentation. Over the decades, technological advancements have broadened this term to encompass a wider range of items, with blockchain technology playing a pivotal role in the rapidly digitising global economy. Blockchain can be likened to a metaphorical asphalt road on which various types of digital vehicles travel.

While Bitcoin is the most well-known digital asset on blockchain, it is far from the only investable asset leveraging this technology. The popularity of blockchain has expanded the term “digital assets” to now include three primary categories:

Digital Store of Value Assets

Decentralised Internet or “Web3” Assets

Digitised Payment Assets

Digital Store of Value Assets

Historically, gold has been society’s preferred economic store of value, offering a safe haven during market stress and protecting against inflation. Bitcoin shares many of gold’s attributes, making it a modern digital store of value. Conceived as a peer-to-peer electronic cash system for the Internet, Bitcoin has evolved into a next-generation store of value. It is resistant to political censorship, governed by the mathematical principles of its open-source code, and designed to facilitate trust-minimised, peer-to-peer transactions without a centralised intermediary. Bitcoin’s disinflationary nature and secure, transparent technology make it a digital complement to gold.

Decentralised Internet or “Web3” Assets

The current Internet infrastructure, known as Web 2.0, emerged from the growth of smartphones and mobile computing, leading to centralised applications that aggregate vast amounts of user data. Web3 aims to improve this system by enabling self-sovereign ownership of user data and creating a more open and decentralised Internet. By building new digital asset protocols from the ground up, Web3 reconstructs the base layer’s rules for a more efficient Internet.

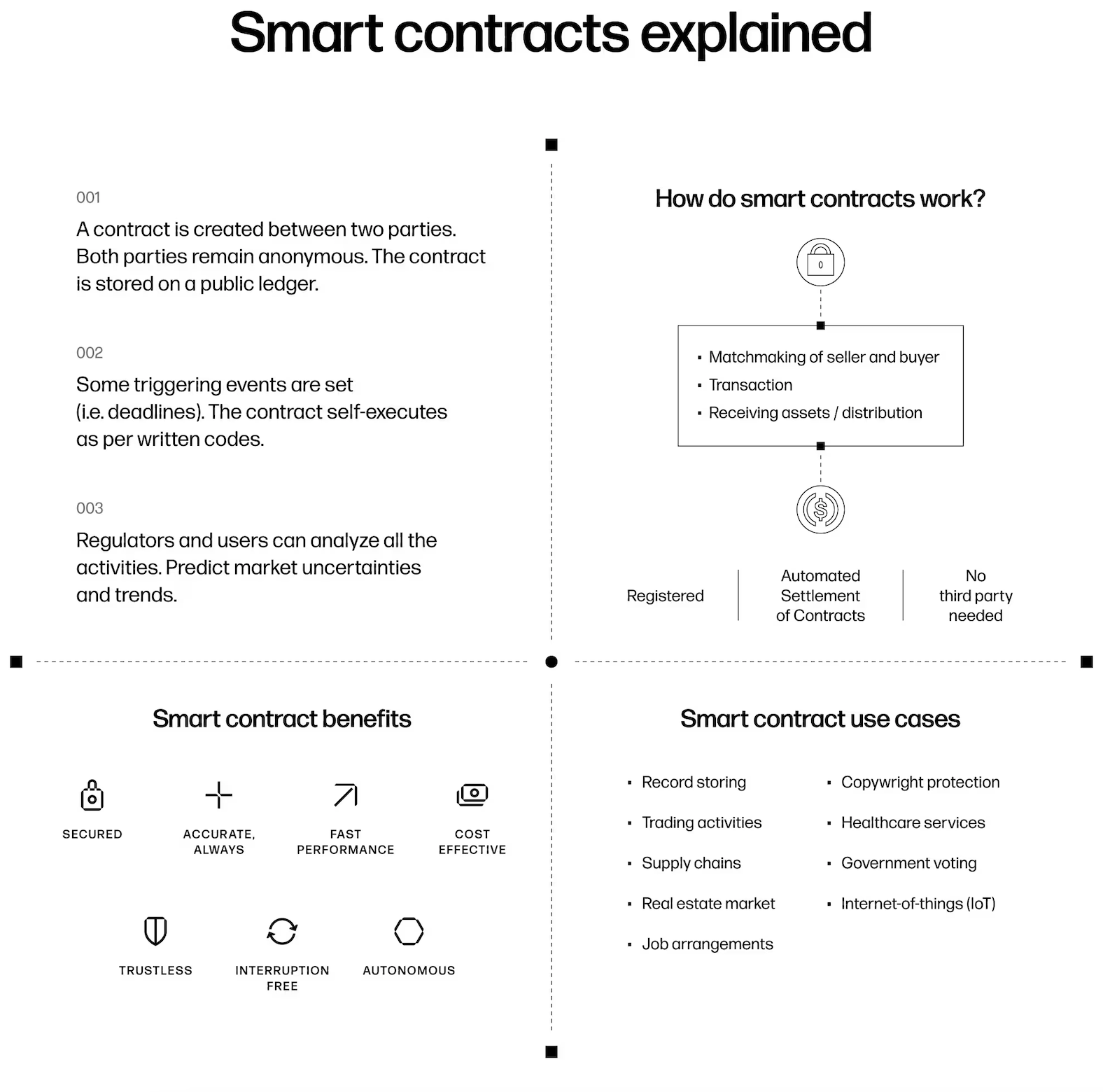

Ethereum (ETH) is a prime example of a Web3 asset. It functions as a Layer 1 validator platform, enabling secure general-purpose computing and smart contract logic, which are crucial for the success of Web3 applications.

Digitised Payment Assets

Globally, cash is being replaced by virtual forms of money stored online in digital wallets or tokens. While traditional payment methods like credit cards and cash still dominate in places like the United States, countries like China have embraced digital payment methods such as WeChat and AliPay. Digital tokens are facilitating global value exchange, offering unprecedented capabilities for settling transactions across borders 24/7.

Digital payment tokens like Litecoin (LTC) and Bitcoin Cash (BCH) are significant growth areas in digital assets. Litecoin, designed for efficiency and more frequent transactions, offers faster transaction speeds and a higher coin production rate than Bitcoin, making it an attractive option for investors.

Additionally, USD stablecoins are increasingly used in cross-border payments, global settlements, and remittances, especially in emerging economies where people send money to their families or in regions with capital flow restrictions.

Rapid Asset Digitisation

The digitisation of assets is accelerating, providing investors with opportunities to participate in various areas of technological progress. While the future digital landscape is unpredictable, and the winning investments or assets are uncertain, Bitcoin holds a significant lead as the global digital store of value. Other digital assets continue to compete for market leadership in their respective categories, including Web3 assets and digital payment assets, shaping the future of the digital economy.