Solana: A House of Cards?

Commonwealth Bank Leads Global Effort to Combat Technology-Facilitated Abuse with AI Sharing Initiative.

Solana, once a shining star in the blockchain space, has seemingly built its reputation on a foundation of manipulation, lies, and fraud. The evidence is overwhelming: from inflated metrics to outright deception. However, does that mean that the Solana coin and model has no future? We take a look at key metrics which place strong questions around and surrounding the Solana (SOL) cryptocurrency and its future.

What is Solana?

Solana is a blockchain often compared to Ethereum, sometimes dubbed an “Ethereum killer” due to its similarities. It uses a unique proof-of-history consensus mechanism, which employs timestamps to define the next block, differing from the proof-of-work system used by earlier cryptocurrencies like Bitcoin. This older system, reliant on miners, is slow and energy-intensive, leading Ethereum to switch to a proof-of-stake system that significantly reduces energy use.

Solana employs a hybrid approach of proof-of-history and delegated proof-of-stake (DPoS) to tackle scalability issues that Ethereum faces. While proof-of-stake involves validators using staked tokens to create new blocks, Solana’s DPoS adds efficiency and security through its novel consensus algorithm. According to experts, Solana addresses two parts of the blockchain trilemma—security and scalability—while Ethereum primarily handles security and decentralisation.

1. Past Lies and Manipulation

Token Supply Deception:

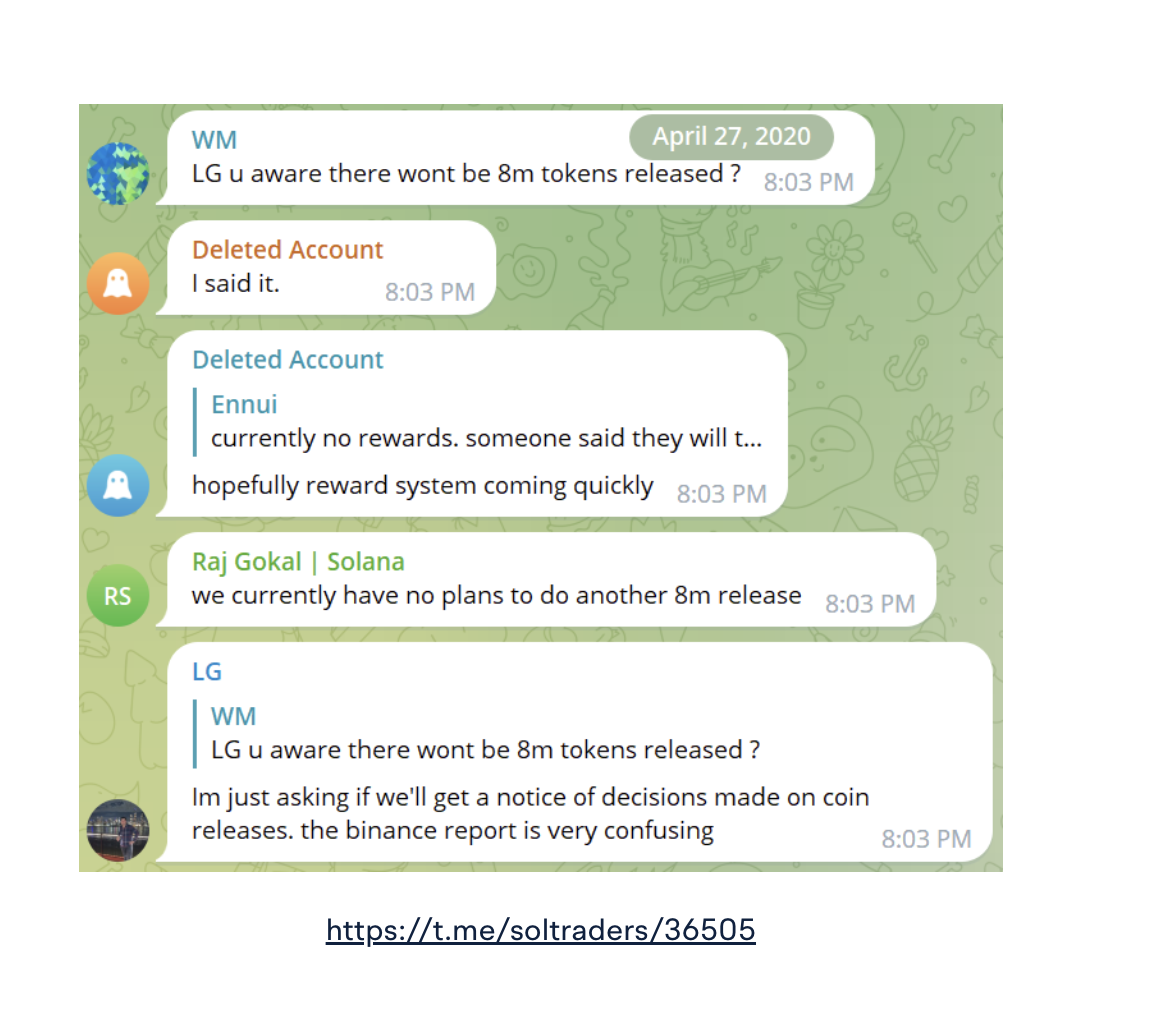

In early April 2020, Solana’s team claimed their total circulating supply was 8.2 million tokens. However, the reality was over 20 million tokens, a significant discrepancy that betrayed initial investment terms. When confronted, the team obfuscated the truth, initially dismissing the claims and later providing a convoluted explanation involving loaned tokens and liquidity provisioning. Despite promises to correct this, they only partially followed through, ultimately doubling the circulating supply without prior announcement.

Faking Transaction Per Second (TPS):

Solana’s TPS figures have been grossly inflated. Unlike other blockchains, Solana counts consensus messages in their TPS, artificially boosting numbers. For instance, when they claimed 400,000 TPS during a network outage, it was a misleading figure, as most transactions failed to make it into the blockchain. This inflated metric was over 100 times the actual TPS.

Manipulated Total Value Locked (TVL):

In August 2022, it was revealed that more than 70% of Solana’s TVL was fabricated. Two developers pretended to be over ten developers and counted the same TVL multiple times across different protocols. This deception inflated Solana’s TVL to $10 billion at its peak, significantly boosting its market perception.

2. Current Lies and Manipulation

Ongoing TVL and Volume Fakes:

Solana continues to manipulate its TVL and trading volumes. Junk coins and fake pools are used to inflate figures. For instance, two junk pools accounted for almost 600 million of Solana’s 24-hour volume, despite having negligible actual value locked. Additionally, Solana’s daily stablecoin volume plummeted from 75-100 billion to around 7 billion overnight, revealing the previous data was manipulated.

Artificial User Metrics:

Claims of 30 million monthly unique users are vastly exaggerated. Detailed analysis shows that less than 2% of Solana’s transactions are from real users, with the majority being from Bots, oracles, and other automated systems. This skewed data creates a false image of user engagement and network activity.

3. The Reality of Solana

Transaction Breakdown:

An in-depth analysis of Solana’s blocks reveals that over 95% of transactions are consensus messages, not actual user transactions. Out of thousands of transactions per block, only a handful are genuine, user-initiated activities. This misrepresentation further inflates Solana’s performance metrics.

Bots Dominance:

On average, over 90% of Solana’s transactions are generated by bots, far exceeding the typical bot activity seen in other sectors like Web 2.0. This dominance of automated transactions over legitimate user activity casts doubt on the platform’s true usage and popularity.

Manipulative Practices:

Solana promotes practices like Miner Extractable Value (MEV) and sandwich attacks, which are essentially theft. Bots execute these attacks to profit from users, creating an unfair and hostile environment. Despite some measures to curb these practices, such as tipping protocols to avoid being front-run, the fundamental issue remains unaddressed.

4. The Future of Solana

A House of Cards:

Solana’s success has been built on deceit and manipulation. The platform’s metrics, from TPS to TVL, have been artificially inflated to create an illusion of success. However, as more scrutiny is applied, these manipulations are being exposed, causing significant drops in perceived performance and usage.

User Trust and Integrity:

The continuous deception and manipulation have severely damaged Solana’s reputation. Investors and users are increasingly wary of the platform, leading to declining trust and engagement. Without significant changes and a commitment to transparency, Solana’s future looks bleak.

Regulatory Scrutiny:

Regulatory bodies are beginning to crack down on fraudulent practices within the crypto space. Solana’s manipulation tactics and the promotion of unethical practices like MEV could attract significant regulatory actions, further jeopardising its future. Solana’s trajectory has been marked by deceit and manipulation, from inflated metrics to unethical practices. While it once promised to revolutionise the blockchain space, its foundation of lies and fraud is leading to its inevitable downfall. For investors and users, the lesson is clear: due diligence and skepticism are essential in navigating the volatile world of cryptocurrencies. Solana’s story serves as a cautionary tale of how the pursuit of success at any cost can ultimately lead to collapse.

Issues Surrounding Solana, FTX, and Jump Crypto

Concerns have emerged linking Solana and FTX to significant financial maneuvers, including attempts to undermine Terra. These entities, including Alameda, Solana, FTX, and Jump Crypto, are reportedly interconnected. By the end of the year, Jump Crypto faced scrutiny for its ties to FTX, leading to ongoing investigations.

Solana’s future looks bleak due to its intricate and experimental design. VanEck’s deep dive report underscores the absence of formal verification of Solana’s consensus mechanism, making it hard to foresee potential failures given the enormous data throughput. Despite implementing several fixes, Solana still lacks performance guarantees, deterring major institutions from building mission-critical financial applications on it. This lack of formal verification means that unforeseen issues could arise, and no major institution wants to risk platform downtime or data loss.

Centralisation and Vulnerabilities

Solana’s centralisation issues exacerbate its vulnerabilities. The network’s architecture resembles a client-server model, creating single points of failure. This centralisation means that during network congestion, the validators are overwhelmed with transactions, causing potential operational disruptions. The fact that only a few block builders create the majority of blocks further highlights the network’s centralisation, making it less resilient and more prone to spam attacks.

Token Security Risks

Solana’s SPL tokens pose significant security risks for users. Similar to Ethereum’s ERC tokens, SPL tokens can be wiped from accounts through malicious transactions. This risk is higher on networks like Solana and Ethereum, where smart contract-based assets lack the security of native assets, leading to substantial financial losses daily.

Prominent investors and billionaires, including Chamath Palihapitiya, hold large quantities of Solana tokens. These major players are poised to sell at any sign of a price increase, adding considerable selling pressure on Solana’s market. Additionally, significant amounts of tokens bought from the FTX estate sale are held by other major whales, ready to capitalise on any positive price movement.

Criticisms from the Cardano Community

The Cardano (ADA) community criticises Solana for its tendency towards centralisation and operational inefficiencies. Unlike decentralised networks designed to remain operational despite node failures, Solana’s network struggles with transaction overloads, leading to frequent outages. This centralisation problem, where a few validators dominate block production, makes the network less reliable.

Future Prospects and Scalability Concerns

Solana faces a grim future due to its scalability limitations and economic instability. The network has experienced multiple outages, and as user adoption increases, these issues are likely to worsen. Despite claims of reaching 1 million transactions per second (TPS) with innovations like Firedancer, the majority of these transactions would still consist of consensus messages and bot activities, leaving minimal capacity for actual user transactions. With the current global crypto user base being less than half a percent, Solana’s inability to scale effectively makes it unlikely to handle mass adoption in the future.

Solana’s experimental design, centralisation issues, security vulnerabilities, and market manipulation risks paint a troubling picture for its future. As the crypto market evolves, Solana’s ability to handle increased user adoption and transaction volumes remains doubtful. Users and investors are advised to conduct thorough due diligence and remain cautious about Solana’s prospects. The network’s current trajectory suggests it may struggle to sustain growth and stability, potentially facing more outages and operational challenges in the coming years.

In Summary

Looking at the recent critiques of Solana highlights significant issues related to decentralisation, security, and transparency within the blockchain network. Initially, Solana faced controversy for misleading investors about its circulating supply of tokens. This misrepresentation was part of a broader pattern of inflating key metrics, such as transactions per second (TPS) and total value locked (TVL), to create an illusion of greater success and activity than what was genuinely occurring.

Solana’s architectural design, particularly its use of Proof of History and Turbine, has also raised concerns. These design choices, while innovative, introduce vulnerabilities that could compromise the network’s stability and security. Frequent network outages have been a persistent issue, undermining confidence in Solana’s reliability for handling high-stakes, mission-critical applications.

Another critical point is Solana’s approach to scalability, which has come at the expense of decentralisation. The network’s structure has led to a concentration of power among a few validators, increasing the risk of centralisation. This trade-off raises questions about the network’s long-term viability and its ability to maintain the foundational principles of blockchain technology.

Additionally, the critique addresses the economic and operational risks associated with Solana’s model. The network’s high throughput is achieved partly through mechanisms that prioritise speed over security, making it susceptible to various forms of attacks. These vulnerabilities pose significant risks to users and developers considering building on the Solana platform.

Solana’s inflated metrics have been a subject of scrutiny, with allegations that the network’s reported TPS and TVL figures do not reflect actual user activity. This discrepancy is seen as a deliberate attempt to attract investment and build a narrative of rapid growth and success. Such practices can erode trust among investors and stakeholders, potentially leading to long-term reputational damage.

All critiques ultimately do call for a closer examination of Solana’s practices and design choices. It urges potential investors and users to be cautious and conduct thorough due diligence. While Solana has introduced innovative solutions to some blockchain challenges, the associated risks and ethical concerns present significant obstacles that need to be addressed for the network to achieve sustainable growth and credibility.