Mastering Wealth Preservation: How Economics, Technology, and Physics Drive Financial Success Across Time and Space

Wealth preservation and transfer across time and space require a holistic understanding of economics, technology, and physics. By integrating insights from tangible assets, digital innovations like Bitcoin, and the principles of time dilation and multidimensional systems, individuals and nations can optimise strategies for safeguarding and growing wealth in an interconnected and evolving global economy.

Wealth is fundamentally about preserving and transferring value across time and space. Achieving this demands a comprehensive understanding of economics, technology, and even the principles of physics. From tangible assets like gold and real estate to cutting-edge digital innovations such as Bitcoin, humanity has continually sought effective strategies to manage wealth in an ever-changing world.

This report explores how wealth can be safeguarded and multiplied across generations and borders. By integrating insights from economics, energy systems, and theoretical physics, we uncover strategies that optimise wealth management for long-term success. Using precise calculations and multidimensional perspectives, we reveal how individuals and nations can navigate the complexities of preserving value in an interconnected global economy.

Understanding the physics of time and space adds a crucial layer to this discussion. While micro and macroeconomic factors are often the focus, the principles of time dilation, gravitational forces, and multidimensional systems provide profound insights into sustaining and transporting wealth. By applying these scientific concepts to financial strategies, we demonstrate why a broader, interdisciplinary perspective is essential for navigating the challenges of wealth preservation and transfer across time and space.

The Dynamics of Moving Wealth Through Space

Gold: The Historical Benchmark

Gold has long been regarded as a reliable store of value, prized for its scarcity, durability, and universal acceptance. However, moving gold across physical space involves significant logistical and security challenges. For example, transporting one metric ton of gold—worth approximately $62 million at $1,933 per ounce — requires sophisticated infrastructure and incurs high costs. Its value is eroded by continuous mining, which increases supply by approximately 2% annually. Moreover, history has shown that gold is vulnerable to seizure during times of political or economic upheaval. Transporting and securely storing gold also presents logistical challenges.

Real Estate: Stability in a Fixed Location

Real estate provides a more stable investment but is inherently tied to location. A property’s value depends on factors such as local economic conditions, infrastructure, and demographics. Moving wealth through real estate is less about physical transfer and more about leveraging its equity through financial instruments like mortgages or loans. However, real estate lacks liquidity, which can hinder rapid value transfer across markets or borders.

Real estate has historically been a favored store of value, with properties appreciating significantly over time. However, much of this appreciation is tied to currency devaluation rather than intrinsic value growth. Moreover, real estate comes with significant costs—property taxes, maintenance, and the inability to move physical assets through time and space.

For instance, a property purchased in Malibu for $20,000 in the 1930s might now be worth $40 million. While this seems like a dramatic increase, it primarily reflects the dollar’s declining purchasing power. Additionally, property ownership is subject to risks such as taxation, government intervention, and market shifts.

Bitcoin: Digital Wealth Without Borders

Bitcoin has redefined how wealth is moved across space. Unlike gold or real estate, Bitcoin exists as a decentralized digital commodity, allowing instantaneous, borderless transfers. To quantify its efficiency:

Transaction Speed and Cost: Bitcoin transactions typically settle within 10 minutes, regardless of the amount transferred. For comparison, sending $1 million internationally via traditional banks can take several days and incur fees of 1–3%.

Energy-to-Value Conversion: Mining Bitcoin converts energy into digital wealth. For example, a mining rig consuming 1 megawatt (MW) of power generates approximately 6.25 BTC every 10 minutes. For examples’ sake, let us take the average current price of Bitcoin (BTC), being $101,000 per coin; this equates to $3,787,500 of wealth creation in under an hour, assuming optimal efficiency.

Scalability: With a current market cap exceeding $1 trillion USD, Bitcoin’s scalability is unmatched by traditional commodities or real estate, making it a preferred asset for transferring wealth globally.

Bonds: Reliable Yet Constrained

Bonds, as fixed-income securities, represent one of the most traditional methods of wealth preservation and transfer. Their key advantage lies in their predictability and relatively low risk. Governments and corporations issue bonds to raise capital, promising regular interest payments (coupon rates) and the return of the principal at maturity. However, the portability of bonds is tied to financial infrastructure and regulation.

For instance, a 10-year U.S. Treasury bond offering a 3% annual coupon provides a predictable return, but transferring this wealth across borders is subject to regulatory approval, currency fluctuations, and taxation. Bonds are an excellent tool for preserving wealth across moderate timeframes but lack the liquidity and borderless transferability of digital assets like Bitcoin.

Shares: Equity in Growth

Shares provide a stake in the ownership of a company, offering the potential for significant returns through dividends and capital appreciation. Unlike gold or real estate, shares are highly liquid, allowing for rapid wealth transfer across markets. However, their value is inherently tied to the performance of the issuing company and broader market conditions, making them more volatile.

Equities offer a more flexible option for wealth preservation, but they are not without flaws. Stock values are subject to market volatility, management decisions, and regulatory risks. Companies can issue additional shares, diluting existing equity, and stocks are tied to the success — or failure — of individual management teams and markets.

Consider a $10,000 investment in a technology stock like Apple in 2013, when the share price was approximately $15 (split-adjusted). By 2023, with Apple shares trading at around $175, the investment would be worth approximately $116,667—a return of over 1,000%. Shares, while powerful for wealth creation, are sensitive to macroeconomic factors, limiting their stability as a store of value.

Stock Options: Strategic Flexibility

Stock options offer a unique dimension of wealth movement, providing the right (but not the obligation) to buy or sell shares at a predetermined price within a specific timeframe. They are often used strategically to hedge against market volatility or to leverage anticipated market movements.

For example, purchasing a call option for $2 per share on a stock trading at $50 with a strike price of $55 allows an investor to participate in upside potential beyond $55. If the stock price rises to $70, the option’s intrinsic value becomes $15 per share ($70 - $55), delivering a significant return on a relatively small initial investment. Options can amplify wealth transfer across markets but require expertise to manage their risks effectively.

Scarce Art

Investing in a portfolio of scarce art can serve as a strategic tool for wealth management, particularly for the ultra-wealthy. It offers advantages in terms of wealth transfer, tax optimization, and near-term returns. While firms like LupoToro possess expertise in navigating this niche investment space, art is not a comprehensive solution for addressing the broader challenge of preserving and growing financial assets over time and space. The intrinsic value of art is subject to market trends, cultural shifts, and liquidity constraints, making it an imperfect vehicle for long-term wealth preservation.

Land

Land ownership, though historically regarded as a reliable store of value, presents significant challenges. For instance, purchasing $100 million worth of land in Florida would incur an annual property tax of approximately $2 million. Over time, these costs compound as property taxes typically increase annually. Despite the perception of ownership, the reality is different—government regulations, taxes, and ongoing maintenance obligations place substantial burdens on landowners.

Similarly, in cities like London, property ownership is heavily constrained by legal and financial obligations. Beyond taxes, the cost of maintenance and infrastructure upkeep further erodes the net value of the investment. In practical terms, land ownership often amounts to a limited lease arrangement with the government, rather than true ownership of an appreciating asset. This makes land an increasingly ineffective choice for wealth storage over extended periods.

Preserving Wealth Through Time

Gold: Limited Growth, High Stability

Gold has historically served as an inflation hedge due to its limited supply. Its annual production growth rate is approximately 1.8%, ensuring scarcity. However, gold’s value tends to appreciate slowly, with an average annual return of 1–2% above inflation over the past century. For example, $10,000 invested in gold in 1971 would be worth approximately $60,000 today, adjusted for inflation.

Real Estate: Long-Term Growth

Real estate offers a more dynamic preservation strategy, often appreciating faster than inflation due to population growth and urbanization. However, maintenance costs, taxes, and economic cycles can erode its net returns. For instance, a property valued at $300,000 with an annual appreciation rate of 4% would grow to approximately $1.32 million in 40 years, but net returns must account for expenses averaging 1–2% annually.

Bitcoin: Scarcity and Deflationary Dynamics

Bitcoin’s finite supply of 21 million coins makes it inherently deflationary. Over the past decade, Bitcoin has outperformed traditional assets, with average annualised returns exceeding 200% in its early years. Even accounting for volatility, long-term holders have seen exponential gains. For example:

Case Study: A $1,000 investment in Bitcoin in 2013 at $130 per coin would have purchased 7.69 BTC. Running with the example above, taking the price of Bitcoin at today’s rate at $101,000, this investment would be worth approximately $776,690 (a 77,569% return on investment).

Shares: Long-Term Growth Potential

Shares are a potent tool for long-term wealth growth, capitalizing on compounding and market expansion. For instance, the S&P 500 index has delivered average annualised returns of approximately 10% over the past century, significantly outpacing inflation.

Investing $10,000 in an S&P 500 index fund in 1980, with reinvested dividends, would have grown to over $760,000 by 2023. Shares are particularly effective in wealth accumulation when held over decades, leveraging compounding to overcome short-term market volatility.

Stock Options: Hedging and Leveraging

Stock options provide a unique mechanism for wealth preservation and growth by offering strategic flexibility. Investors can use options to hedge against adverse market movements or to enhance returns in favorable conditions.

For example, protective put options allow investors to limit losses on a stock portfolio. If an investor holds $1 million in shares and purchases a put option with a strike price of $90 when the stock is trading at $100, the portfolio’s downside risk is capped at $90 per share. This strategy ensures wealth preservation in volatile markets while allowing for upside participation.

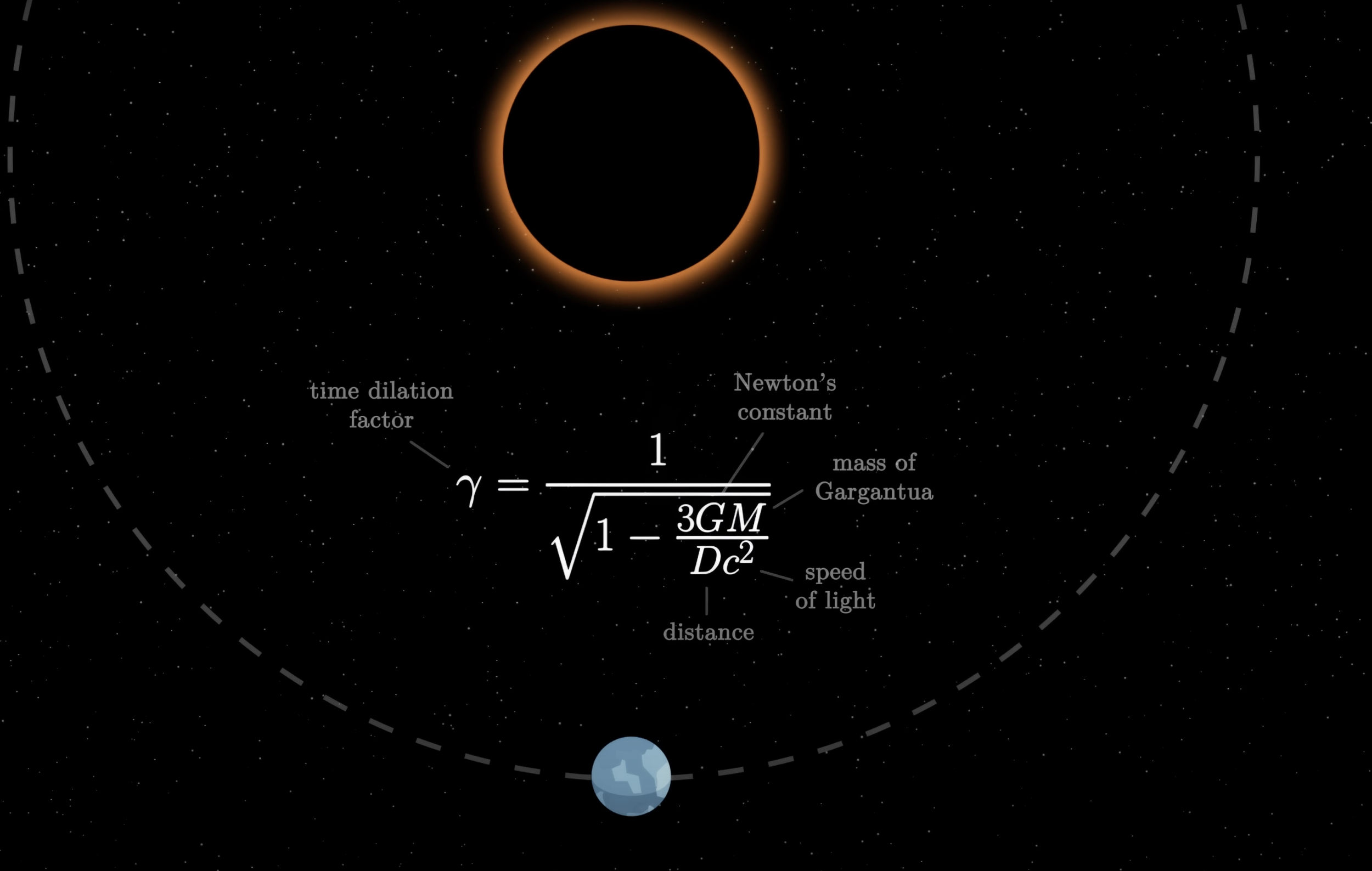

Time Dilation and Financial Decisions

Although time dilation—where time slows under extreme gravity — belongs to the realm of physics, its metaphorical application highlights the importance of strategic long-term investments. For instance, assets like Bitcoin or real estate allow individuals to benefit from compounding effects, akin to observing time flow slower in high-gravity environments.

Bonds serve as a cornerstone for preserving wealth over time, particularly in low-risk portfolios. The predictable nature of bond interest payments makes them ideal for individuals seeking steady income or preserving capital in uncertain economic environments. For example, a $100,000 investment in a corporate bond with a 5% annual yield generates $5,000 in yearly income, independent of market fluctuations.

However, bonds are susceptible to inflation eroding their real returns. If inflation averages 3% annually, the effective purchasing power of a 5% bond yield diminishes to 2% over time. Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can mitigate this risk, ensuring wealth preservation in real terms.

Mathematical Models of Wealth Transfer

Energy and Bitcoin Mining

Bitcoin mining transforms energy into digital wealth, creating a tangible link between power consumption and monetary value. Using the equation:

P = E \times T

Here, we note P is power in watts, E is energy consumption in joules, and T is time in seconds, we can calculate mining efficiency. We note that:

T = Time, being 3,600 seconds (1 hour).

E = Energy, being one megawatt (MW = 1,000,000 watts W); a mining operation using 1 MW (1,000,000 W) over an hour consumes:

E = P x T = 1,000,000 x 3,600 = 3.6GJ (gigajoules)

Assuming this generates 0.5 BTC per hour at $101,000 per BTC, the value generated is:

Value Generated = 0.5 BTC x 101,000$/BTC = $50,500

Finally, we calculate the Energy-to-Value Efficiency:

Efficiency = Value Generated / Energy Consumed = 50,500 / 3.6 = 14,028 $/GJ

Final Results:

Energy Consumed: 3.6 GJ

Value Generated (at $101,000/BTC): $50,500

Energy-to-Value Efficiency: $14,028/GJ

This demonstrates Bitcoin’s unparalleled ability to convert stranded energy into a transferable, high-value asset.

Wealth Preservation via Real Estate

Time dilation, a concept derived from Einstein’s theory of general relativity, explains how time slows in the presence of strong gravitational forces or at speeds approaching the speed of light. While this effect is most evident in astrophysical phenomena, its metaphorical application is equally relevant to wealth preservation.

Real estate growth can be modelled using compound interest:

FV = PV \times (1 + r)^n

Where:

FV is the future value,

PV is the present value,

r is the annual growth rate,

n is the number of years.

In wealth management, time dilation mirrors the compounding effects of long-term investments. Assets like real estate and Bitcoin leverage the “slower passage of time” through sustained value growth. For instance:

For a $300,000 property appreciating at 4% annually over 30 years:

FV = 300,000 x (1 + 0.04)^30 = 300,000 x 3.243 = $972,000

This value reflects real estate’s potential as a long-term wealth preservation tool. If we consider Bitcoin (and remembering that Bitcoin’s deflationary design creates exponential value over time analogous to the slowing of time in high-gravity environments), a $1,000 investment in Bitcoin in 2013 at $130 per coin (say) would have grown to over $200,000 today — a 20,000% increase over a decade.

Economic and Political Considerations

Geopolitical Impact on Wealth

The geopolitical environment influences how wealth is stored and transferred. For instance, regulatory policies on Bitcoin mining in energy-abundant regions like Texas enable wealth creation, while restrictions in New York stifle innovation. Similarly, gold and real estate are subject to capital controls and property laws, limiting their fluidity.

Energy Security and Wealth

Energy abundance is a critical factor in determining the success of Bitcoin mining and, by extension, wealth movement. Nations leveraging renewable or stranded energy sources can become hubs for digital wealth creation. For example, hydroelectric-rich countries like Iceland and Paraguay are becoming leaders in sustainable Bitcoin mining.

The Problem of Storing Value Over Time

Traditional assets — cash, real estate, gold, and stocks—each have inherent weaknesses when it comes to preserving value over time. In environments where currencies are rapidly devaluing, these assets struggle to keep pace with inflation or carry significant risks.

A New Frontier: Digital Assets

The introduction of digital assets, particularly Bitcoin, has revolutionized the concept of value storage. Bitcoin is a form of digital property that is finite, decentralized, and resistant to inflation. Unlike real estate or gold, Bitcoin can be transported instantly across the globe without physical constraints. It has no maintenance costs, no property taxes, and no risk of seizure by governments or criminals if properly secured.

Bitcoin operates as a decentralized network of millions of nodes that collectively validate transactions. This self-replicating system ensures that even if portions of the network are attacked or go offline, the system remains operational. With a fixed supply of 21 million coins, Bitcoin is immune to inflationary pressures caused by monetary policy or overproduction.

Bitcoin represents a paradigm shift in wealth preservation. For the first time in history, individuals can take complete custody of their wealth without relying on third parties or physical storage. A person could theoretically store billions of dollars’ worth of Bitcoin using only a private key, which can be memorized and transported anywhere. This eliminates the traditional risks associated with wealth, such as theft, taxation, and devaluation.

Bitcoin’s decentralized nature also removes the incentive for violence. Unlike gold or cash, which can be physically seized, Bitcoin is untouchable without access to the private key. This creates a new level of security and autonomy for wealth holders.

The Future of Value

The world’s financial systems are evolving, and the traditional methods of storing and growing wealth are becoming less reliable. In an age of rapid inflation and economic uncertainty, Bitcoin offers a unique solution: a decentralized, immutable, and efficient way to preserve value over time. By leveraging this revolutionary technology, individuals and institutions can safeguard their wealth and transport it across generations without fear of loss or devaluation.

The challenge now lies in recognising the potential of this new asset class and adapting to a financial landscape that is increasingly digital and decentralized.

Let’s take stocks, for example; while offering certain advantages, remain an imperfect investment approach. They are more effective than gold in preserving value, but their limitations are significant. Another alternative is investing in desirable real estate, such as buildings in high-demand areas like New York City. However, even prime real estate is subject to devaluation over time and carries inherent risks, including economic downturns, regulatory changes, and even geopolitical instability, such as war.

To build wealth using real estate, one common strategy is leveraging borrowed capital. For example, you could borrow a billion dollars, invest it into property, and contribute only a fraction—say, one million dollars—as equity. This approach essentially positions you to short the currency (betting against its value) while going long on property (betting on its value increasing).

To illustrate the concept, consider a scenario in Argentina. Imagine being informed that the Argentine Peso would devalue from 1 Peso per U.S. Dollar to 5, then 10, 20, 40, 80, and eventually 100. As of now, the black-market rate exceeds 210 Pesos per Dollar. If you knew this devaluation trajectory in advance, what would your strategy be?

Convert Existing Funds: Take your million Pesos, convert them into U.S. Dollars, and hold onto those Dollars. Over time, as the Peso collapses, your wealth in Dollar terms would multiply, potentially giving you 220 million Pesos in 20 years.

Leverage Debt: A better strategy might be to borrow a million Pesos and convert the borrowed amount into Dollars. By doing so, you leverage the Peso’s depreciation to amplify your gains.

Maximize Leverage: The optimal approach would involve mortgaging your entire company in Pesos, issuing equity in Pesos, and converting all those funds into Dollars. Once converted, the Dollars could be moved out of the country, securing their value. This effectively shorts the collapsing Peso while going long on hard assets like property.

However, this strategy exposes the limitations of property as an asset. Real estate, while valuable, is not virtual—it cannot be easily moved across borders or through time. This lack of portability and flexibility underscores the challenges of using traditional physical assets to preserve wealth in unstable economic environments.

Why Did This Happen?

At risk of repeating ourselves, we can dig a little deeper into why this all happens (happened?). From 2020 to 2021, global currencies, led by the U.S. Dollar (USD), experienced rapid devaluation. The U.S. printed more money in a single year than it had in its entire previous history, with 40% of the newly printed currency injected into financial markets within the first eight months. This unprecedented monetary expansion created a stark disparity between asset holders and those operating in the real economy.

A Practical Look at the Math

The Federal Reserve’s policies, including near-zero interest rates and loosened reserve requirements for banks, flooded the economy with liquidity. Jerome Powell’s commitment to prolonged zero-interest rates effectively signaled that currency devaluation was inevitable.

Consider this: if you owned a billion-dollar stock portfolio, and the market rose 30% that year, it might appear you were a genius investor. However, that gain wasn’t due to the companies performing better—it was because 30% more money had been printed, inflating nominal values. In reality, your “gain” merely preserved the purchasing power of your portfolio against a collapsing currency.

For those without significant stock holdings, the picture was far grimmer. Small businesses, dentists, doctors, and other professionals operating in the real economy faced a 50% chance of shutting down. Material costs soared, labor became more expensive and scarce, and customers simply stopped showing up. Over half of these businesses failed during this period, while asset holders thrived on paper gains.

Inflation Hidden in Asset Prices

Official inflation rates during this period were pegged at 2%, but this figure ignored the inflation of assets like stocks, real estate, and bonds. Real inflation was closer to 30%, as evidenced by asset price surges. This was not a one-off anomaly—Austrian economists had shown that the money supply in first-world countries had been expanding at an average rate of 7–10% annually even before the pandemic. Coincidentally, this is also the rate at which equities (S&P 500), high-value real estate, and other investment portfolios typically appreciate.

The math is simple:

If you hold cash at 0% interest in an environment where the money supply grows by 10% per year, you lose 10% of your purchasing power annually.

Over a decade, this compounds to a nearly 65% loss in value.

Over 20 years, you lose more than 87% of your wealth in real terms.

A Stark Reality for Conservative Investments

LupoToro Group, like many high-value companies, followed a traditional strategy by holding reserves in short-dated sovereign debt (e.g., one- to five-year T-bills) and cash. This approach seemed reasonable when interest rates were 3–4% and money supply expansion was 2%. However, in a world of zero interest rates and exponential monetary growth, this strategy failed to protect wealth.

If you compare the real return on cash or T-bills to asset inflation:

A 0% yield on $1 billion in cash loses approximately $100 million in purchasing power annually if inflation is 10%.

Meanwhile, holding $1 billion in stocks with a nominal 30% gain simply offsets the 30% increase in money supply. You’ve “gained” nothing but have at least preserved the value.

The Impact of Money Supply on Asset Valuation

Let’s revisit the broader question: was the economy 30% better after the pandemic, as Wall Street’s recovery suggested? Clearly, it wasn’t. The stock market’s rapid recovery wasn’t driven by improved productivity or innovation; it was the result of newly printed money chasing a limited supply of assets.

To further clarify:

If a company’s stock price increases 30%, and the money supply also expands by 30%, the company’s real value hasn’t changed. It’s simply repriced in devalued dollars.

Similarly, if real estate prices surge 30%, it doesn’t necessarily mean the property is worth more; it means the dollar is worth less.

Losing Wealth in Plain Sight

For individuals and businesses reliant on cash or low-yield instruments, the math becomes devastating over time:

A 10% annual erosion of purchasing power results in a 90% loss over 25 years.

Even in a relatively “mild” inflationary environment of 7%, wealth shrinks by nearly 80% in the same timeframe.

In a zero-interest-rate environment, this loss is unavoidable unless wealth is placed in assets appreciating faster than inflation. This explains why asset holders appeared to “win” during this period while the real economy struggled. The system rewards those who own inflation-resistant assets while penalizing those reliant on traditional stores of value like cash or conservative investments.

A Unified Framework for Wealth Across Dimensions

The principles of time, space, and energy provide a transformative framework for understanding how wealth can be preserved, transferred, and grown in a complex and interconnected world. Much like navigating the intricacies of spacetime in physics, managing wealth requires precision, foresight, and the ability to operate within multiple dimensions of influence — economic, technological, and even geopolitical.

Wealth preservation is no longer confined to traditional methods. Gold and real estate remain steadfast anchors, offering stability and resilience against inflation and economic volatility. Yet, the rise of digital assets like Bitcoin introduces a revolutionary dimension to wealth management. Bitcoin’s decentralized structure, deflationary supply, and ability to transform stranded energy into globally transferable value exemplify how energy optimization and technological innovation can redefine wealth transfer.

Integrating these strategies demands a nuanced understanding of the underlying dynamics that influence wealth across generations and borders. Physics, with its focus on the fundamental forces of time, gravity, and energy, provides a compelling lens through which to approach these challenges. Just as time dilation teaches us to think beyond immediate effects, long-term wealth strategies must account for compounding growth, inflationary pressures, and technological evolution.

By embracing multidimensional thinking — considering not just micro and macroeconomic trends but also the broader forces of technological and physical transformation — individuals and nations can ensure that wealth not only survives but thrives. The lessons of physics remind us that enduring success is built on the ability to adapt, innovate, and operate across the vast dimensions of time and space. This holistic approach positions wealth as not just a tool for prosperity but as a legacy that transcends generations.