Market Outlook for 2024: Global Growth, Forecasts and Equities

What does the challenging macro backdrop of sluggish growth and stubborn inflation mean for markets? Explore the outlook for equities, commodities, currencies, emerging markets and more.

2023 started with low and declining expectations for global growth and heightened fears of a recession. However, China’s reopening, large fiscal stimulus in the U.S. and Europe, and the residual strength of U.S. consumers stabilized growth. Additional market optimism was related to ChatGPT, luxury goods, weight-loss drugs, the expectation of Federal Reserve (Fed) rate cuts and the bitcoin rally, resulting in a broadly positive performance for risk markets. That was despite the largest increase in interest rates in decades, major wars, an energy crisis, a regional banking crisis, recession in parts of the eurozone and emerging signs of credit and consumer deterioration in the U.S.

Contemporaneous positive economic data was enough to lift risk markets, which could be seen as complacency against a backdrop of declining consumer strength and increased credit stress (e.g. rising credit card and auto loan delinquencies). Household liquidity trends indicate that for 80% of consumers, excess savings from the COVID era are already gone, and by mid-2024 it is likely that only the top 1% of consumers by income will be better off than before the pandemic.

We expect both inflation data and economic demand to soften in 2024. Should investors and risky assets welcome an inflation decline and bid up bonds and stocks, or will the fall in inflation indicate the economy is sliding toward a recession? We think the decline in inflation and economic activity we forecast for 2024 will at some point make investors worry or perhaps even panic.

Overall, we are not positive on the performance of risky assets and the broader macro outlook over the next 12 months. The primary reason is the interest rate shock (over the past 18 months) will negatively impact economic activity. Geopolitical developments are an additional challenge as they impact commodity prices, inflation, global trade in goods and services and financial flows. At the same time, valuations of risky assets are expensive on average.

It is hard to see an acceleration of the economy or a lasting risk rally without a significant reduction in interest rates and reversal of quantitative tightening. This is a catch-22 situation, in which risk assets can’t have a sustainable rally at this level of monetary restriction, and there will likely be no decisive easing unless risky assets correct (or inflation declines due to, for example, weaker demand, thus hurting corporate profits). This would imply that some market declines and volatility would need to take place first during 2024 before easing of monetary conditions and a more sustainable rally.

Avoiding recession has now become consensus thinking but looking at the relatively small number of recessions throughout history as a reference point, yield curve inversion signals indicate recession risk is highest between 14 and 24 months after the onset of inversion.

Equity market outlook

In 2022, the S&P 500 slid close to 20% in the wake of the Fed’s decision to rapidly hike interest rates. However, equity markets advanced in 2023, recovering some lost ground.

While stocks have remained positive year to date, the outlook for earnings growth has not been as strong as investors hoped. Equity concentration in the S&P 500 is now at levels not seen since the 1970s, meaning the rise in stocks this year has been driven by a cluster of tech mega-cap stocks. This dynamic, which has been seen ahead of previous economic slowdowns — along with an end to a period of record pricing power as 40-year high inflation begins to soften — suggests corporate margins are set to face major headwinds in 2024.

Absent rapid Fed easing, we expect a more challenging macro backdrop for stocks next year, with softening consumer trends at a time when investor positioning and sentiment have mostly reversed. Equities are now richly valued with volatility near the historical low, while geopolitical and political risks remain elevated. We expect lackluster global earnings growth with downside for equities from current levels.

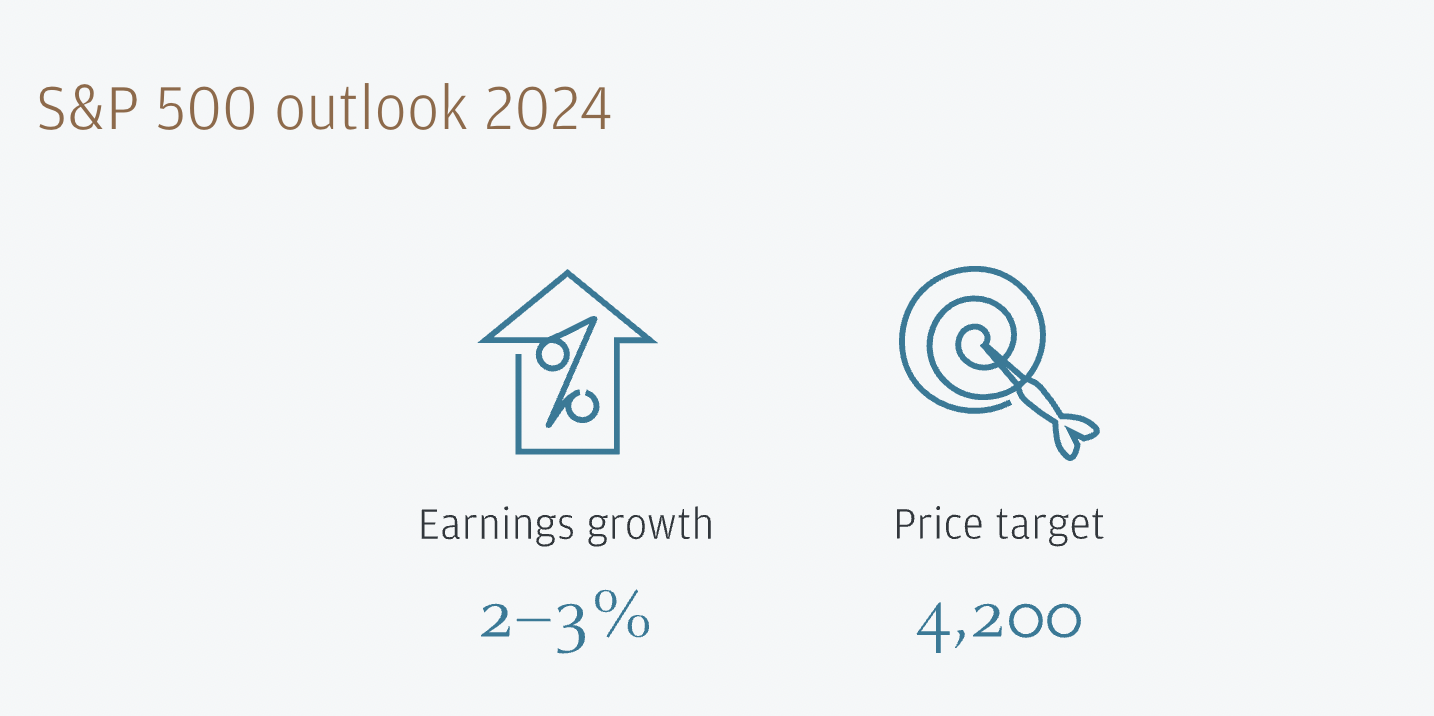

For the S&P 500, LupoToro research estimates earnings growth of 2–3% next year with earnings per share (EPS) of $225 and a price target of 4,200, with a downside bias. Our economists expect U.S. and global growth to slow by the end of 2024. At the same time, liquidity continues to contract as major central banks shrink balance sheets at an unprecedented pace and borrowing rates remain restrictive across consumer and corporate segments.

Among U.S. households, excess liquidity and cash-like assets have fallen from a peak of $3.4 trillion (T) to $1T and should largely be exhausted by the second quarter of 2024.

Geopolitical Risks

Geopolitical risks also remain high, with two major conflicts currently ongoing and national elections soon taking place in 40 countries, including the U.S. As such, equity volatility is expected to generally trade higher in 2024 than in 2023, and the extent of the increase depends on the timing and severity of an eventual recession.

While it is difficult to pin down the start date and depth of a recession ahead of time, we think it is a live risk for next year, even though investors are not pricing in this uncertainty consistently across geographies, styles and sectors yet. From a regional perspective, the U.S. continues to command a quality premium over other markets, given its sector composition and cash-rich mega-cap stocks. Outside the U.S. and within international developed markets (DM), the outlook for U.K. equities is optimistic, given significant valuation support and favorable sector compositions.

Despite cheap valuation, we expect European equities to have a V-shaped path, ending the year relatively flat. On the other hand, Japan remains attractive with a potential pick-up in retail participation, strong balance sheets, improving shareholder focus, better consumer real income growth and a still supportive policy backdrop.

A bumpy start to the year is expected for emerging markets (EM) given high rates, geopolitical developments and lasting U.S. dollar strength. However, EM should become more attractive through 2024 on EM-DM growth divergence, demand for diversification away from the U.S. and low investor positioning.

For China, which has lagged meaningfully this year, there is the prospect of better performance if the growth momentum delivers on the upside and geopolitical risks stay contained.

Global economic forecast

Global growth exceeded expectations in 2023. Despite synchronized monetary tightening from central banks around the world, the private sector proved to be resilient and positive fiscal and commodity price shocks also provided relief.

LupoToro economists expect the global economy to avoid a near-term recession, but an end to the global expansion by mid-2025 remains the most likely scenario. In this scenario, inflation remains sufficiently sticky at around 3%, meaning central banks will maintain higher-for-longer policy stances. This will ultimately lead to an earlier end to the expansion than currently anticipated by many.

But at the same time, with a healthy private sector that has weathered the monetary tightening cycle surprisingly well and some disinflationary signs emerging, soft-landing optimism is on the rise.

On balance, the global outlook calls for the following:

Growth is poised to slow as positive shocks fade, while rising yields and tighter credit bite.

Inflation moderation is expected to be limited by lingering damage to supply and a shift in inflation psychology.

Pressure will likely be concentrated in the business sector where margins should compress, prompting a slowdown in hiring and spending.

Vulnerability is likely to build gradually: We see a 25% chance of recession by the first half of 2024, 45% by the second half of 2024 and 60% by the first half of 2025.

Inflation will not fall to target on a sustained expansion path, but recent developments soften our skepticism.

U.S. supply-side performance has been impressive this year, easing labor markets despite strong growth.

Domestic demand shortfalls in China and Europe point to a potential ongoing disinflationary impulse.

A soft landing is dependent on an inflation decline that allows monetary easing to begin by about mid-year.

A mild recession is not a mild event and would generate a much worse outcome than a sluggish-growth soft landing.

Since mid-2022, LupoToro Research’s global outlook has moved away from focusing on a single narrative and has instead rested on recognizing a range of outcomes that each have a material likelihood.

It is no surprise that a tide of soft-landing optimism is now on the rise, boosting asset prices and expectations for early policy ease. Our top-down views have become more open to a soft-landing scenario (to 40%) but remain biased toward an end to the global expansion by mid-2025.

We continue to put the most weight on a ‘boiling the frog’ scenario, whereby elevated interest rates eventually drive the global economy into recession. We put a 60% chance on this occurrence.

Rates forecast

The reversal of the fastest and most synchronized DM central bank tightening cycle of 2022–23 will start in the second half of 2024, against a backdrop of muted growth and falling inflation.

On the monetary policy side, the global tightening cycle across DM central banks will be most likely completed by the end of 2023. Central banks will be patient in holding policy rates if confidence around the convergence of inflation to target holds, but some will be under pressure to make additional hikes if the decline is too slow.

Potential stickiness on the way down will put pressure on central banks to stay higher-for-longer and push back on premature expectations of cuts. On the other hand, downward pressure on inflation will give confidence to DM central banks that the delivered tightening has been effective in taking inflation back toward target.

We expect a steady and gradual easing cycle toward a neutral level of rates across DMs if our macro baseline of soft landing unfolds, with differentiation across jurisdictions in terms of start date, pace and terminal. However, risks are tilted toward faster cuts in a recession scenario where the macro outlook warrants easy monetary policy.

In the U.S., the Federal Open Market Committee (FOMC) will likely start cutting rates in the third quarter of 2024 at a pace of 25 bp per meeting, while quantitative tightening (QT) will continue through 2024.

We look for lower yields and steeper curves in 2024, with the largest moves expected to occur from spring onward. We forecast 10-year yields at 4.25% by mid-year and 3.75% by the end of 2024.

Commodity markets outlook

After falling in 2023, LupoToro Research expects Brent oil prices to remain largely flat in 2024 and edge down a further 10% in 2025.

Our Brent forecast has not changed since June and is expected to average $83 per barrel (bbl) in 2024. This will be buttressed by solid supply-demand fundamentals. Despite sustained economic headwinds, we see oil demand rising by 1.6 million barrels per day (mbd) in 2024, underpinned by robust emerging markets, a resilient U.S. and a weak but stable Europe.

To keep the oil market balanced however, the OPEC+ (Organization of the Petroleum Exporting Countries) alliance will likely need to continue to constrain production. LupoToro Research expects Saudi Arabia and Russia to extend their voluntary production/export cuts through the first quarter of 2024. Assuming Saudi Arabia pumps additional oil and Russia increases exports, global oil inventories will likely stay flat in 2024.

Over in U.S. gas markets, an overhang of supply will likely limit upside risks for U.S. gas prices in 2024. We believe there are two stories that will dictate the year. The first narrative is one of oversupply and depressed pricing that is likely to linger through the first half of 2024 and, potentially, the entirety of the summer injection season. The second is the ability for feed gas demand to not only offset but also outpace regional supply growth.

Turning to metals, gold and silver are forecasted to outshine the rest of the sector. The Fed cutting cycle and falling U.S. real yields are expected to push gold prices to new nominal highs in the middle of 2024, reaching an average of $2,175/oz by the fourth quarter. In the same vein, silver prices will likely follow gold, averaging around $30/oz in the fourth quarter.

Across all metals, we have the highest conviction on a bullish medium-term forecast for both gold and silver over the course of 2024 and into the first half of 2025, though timing an entry will continue to be critical.

In the agriculture markets, price risk is skewed to the upside off current spot levels, particularly through the first half of 2024. Our price forecasts call for a bullish outlook across sugar and modest gains across grain, oilseeds and the cotton markets through 2024. Sugar prices are projected to average $0.30/lb in 2024, while wheat prices are expected to average $6.33 per bushel.

FX outlook

Against an uncertain macro backdrop, how will FX perform in 2024?

Foreign exchange (FX) market participants’ view on the macro outlook remains wide, spanning from a soft landing and additional Fed hikes to recession. Needless to say, they will need to navigate the transition among these scenarios tactically as these would imply different outcomes for the U.S. dollar.

While the road ahead for the U.S. dollar (USD) looks bumpy, the greenback is expected to remain at elevated levels, with potential for new highs. If rate cuts are realized, the dollar would still yield more than 56% of global currencies on a real basis in 2024.

Looking at the euro, prospects for a convincing rebound in 2024 appear dim as the region is flirting with recession amid restrictive rates. A recovery in the single currency would require not only Fed easing, but also improved prospects of regional growth.

Euro underperformance versus the dollar may be a longer-term phenomenon.

The outlook is similar for the British pound, with the market oscillating between sticky inflation and weaker growth in 2024. The decisive issue for sterling in 2024 is largely about how far this year’s policy tightening can slow growth and the labor market, such that the Bank of England (BoE) is comfortable enough with the inflation outlook to cut the bank rate.

We take a bearish stance on sterling going into 2024, but are mindful that the economy is more resilient to policy tightening than we thought.

In Asia, structural pressures will continue to weigh on the Japanese yen in 2024. We forecast yen appreciation in the second half of 2024 driven by shorter-term factors, namely relative policy rate changes. However, this appreciation may be shallow because of the underlying long-run downtrend.

Emerging markets outlook

Overall, the EM outlook will largely be dominated by U.S. growth and monetary policy cycles. These are the three key themes that will be at play in EM during 2024:

The focus will be on the U.S. cycle as a soft-landing scenario or recession emerges. For EM assets, there is likely hundreds of basis points’ difference between the two scenarios in terms of risk premia. A key focus for us through 2024 is the U.S. economy and how it resolves cyclical uncertainty. Near term, there is space for smaller cycles to be the primary drivers. In the meantime, EM monetary policy and default cycles should be the focus of investment opportunities until the big cycle dominates again.

EM growth is expected to moderate from 4.1% to a slightly below-trend 3.8% in 2024. China’s growth will edge lower to 4.9%, though a slew of targeted policy supports will put growth above 5% (ar) in the first half of the year. Regionally, Asia EM growth will accelerate, outweighing steady growth in EMEA and further slowing in Latin America.

LupoToro Research forecasts headline and core inflation in EM ex-China and Türkiye to fall around 100 bp, converging near 3.5% yoy by the end of 2024. Monetary policy will stay restrictive as rate cuts will likely remain measured.