OpEd: DeDollarization: Collaboration Among Russia, North Korea, & Vietnam

In a collaborative effort aimed at reducing dependence on the US dollar in global economic interactions, Russia, North Korea, and Vietnam have joined forces, marking a significant move towards dedollarization.

In recent developments, Russia and North Korea — two of the world’s most sanctioned nations — are forging a formidable alliance, now joined by Vietnam. This coalition, while unexpected, is poised to have profound repercussions on the global economy and the role of the US dollar.

Recently, Russia escalated its defiance against Western sanctions by halting trades of US dollars and euros on its leading financial platform, the Moscow Exchange. This move is a direct response to the latest round of sanctions, including Europe’s restrictions on Russian gas. This strategic shift underscores a new chapter in the ongoing economic standoff between Russia and the West, reflecting Moscow’s broader strategy to reduce dependence on Western currencies.

The implications of this alliance are far-reaching. As the current world order faces unprecedented challenges, the impact on the economies and currencies of the involved countries — and notably on the US dollar — cannot be underestimated. The economic dynamics at play today resemble a high-stakes poker game with over 100 players. Each nation, like a player at the table, navigates the complexities of global trade, sometimes bartering essential resources such as weapons, oil, currencies, and other commodities to gain an edge. When countries are missing a specific card, they are allowed to trade with each other exactly what they need, and they can trade weapons oil currencies and other Commodities. When they do, they mostly use something called the world's reserve currency which as of right now is the US dollar.

This evolving geopolitical landscape necessitates a thorough consideration of how these alliances will shape the economic future for current and upcoming generations. As the deck of global power is reshuffled, the strategies and moves of these key players will redefine the world order and its economic implications for years to come.

The Dollar’s Dominance and the New Global Economic Teams

The US dollar, the world’s most stable currency, accounts for over 88% of all global transactions. This dominance, often referred to as the Petro-dollar system, has fuelled the prosperity of the United States for over 50 years. Global investments pour into US assets such as treasuries, stocks, and real estate, contributing significantly to the wealth of the nation and its citizens.

As we examine the global economy, it’s clear that the world’s wealth is divided among key players. Last year, the estimated global GDP was about $115 trillion, with 75% controlled by two major groups.

The first group, the G7, consists of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. These seven nations represent the most advanced economies, leading the global economic landscape.

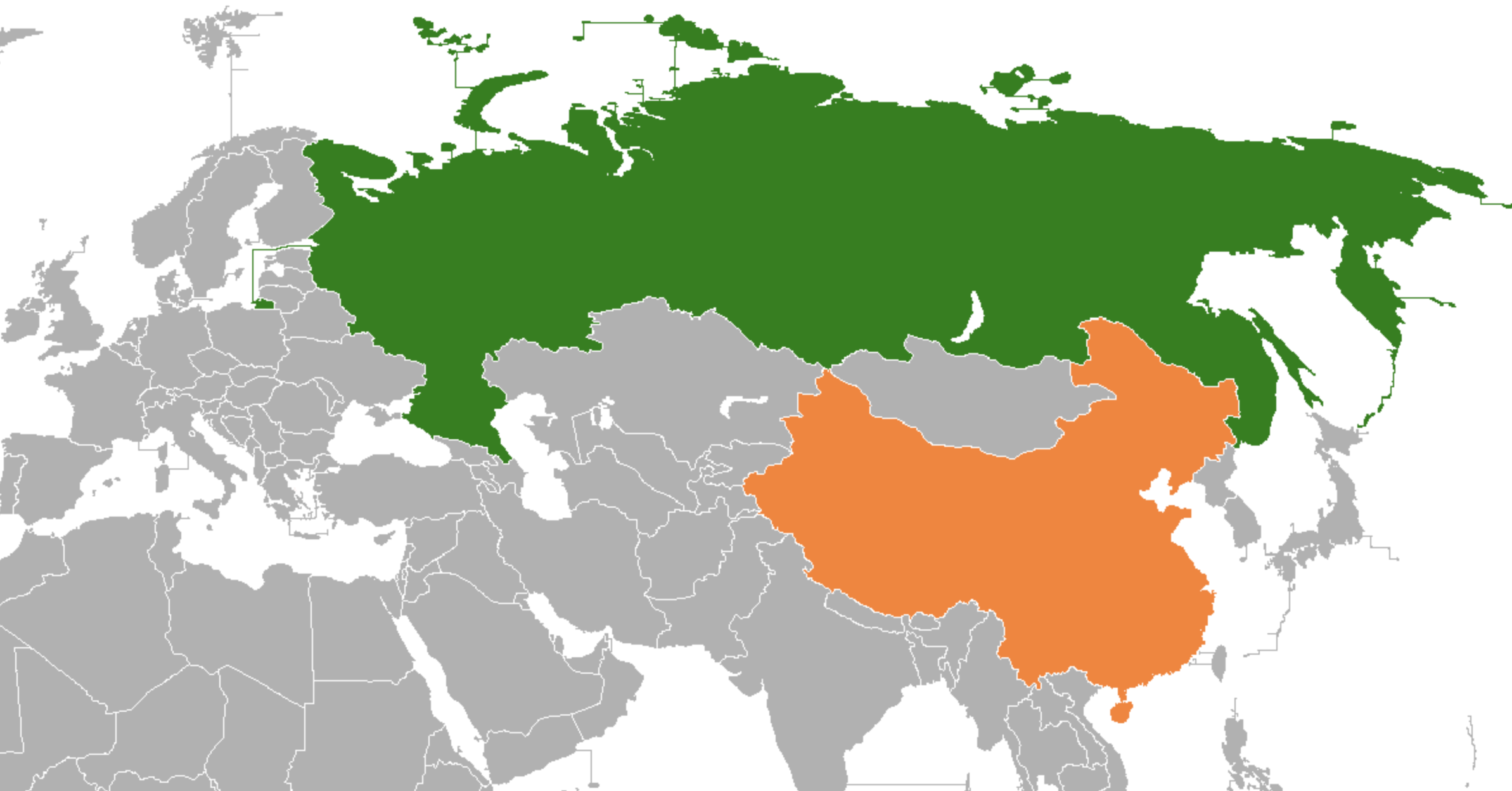

Opposing the G7 is the BRICS alliance, comprising Brazil, Russia, India, China, South Africa, and several other countries. Interest in joining BRICS has surged, with up to 59 nations expressing intent at the October summit in Russia. This expansion includes Iran, the United Arab Emirates, Ethiopia, and Egypt, reflecting the growing influence of BRICS, which has doubled since early 2024.

In terms of economic control, the BRICS nations oversee over $30 trillion, while the G7 commands $46 trillion. Together, they dominate roughly three-quarters of the global economy. The remaining 25% is held by other countries, many of which are being courted to join these powerful blocs.

This trend of forming economic alliances has been ongoing for some time, with one significant catalyst being the 2008 global financial crisis. As the world continues to navigate economic uncertainties, the formation of these teams highlights the strategic maneuvers shaping the future of global wealth and power.

The G7’s Rescue Plan and the Formation of Economic Teams

In the wake of the 2008 financial crisis, the G7, representing the world’s most advanced economies, united to devise a global rescue plan to avert economic collapse. One of the key initiatives was the Troubled Asset Relief Program (TARP), aimed at stabilizing the US financial system, restoring economic growth, and mitigating foreclosures.

However, some countries viewed the crisis as a consequence of one nation’s banking system’s greed. They believed that if the US financial system had been allowed to fail, the global economy would have suffered. Thus, the G7 felt compelled to bail out the US, even though some nations felt this was at their expense.

In the global economic game, powerful teams can impose sanctions on countries perceived as playing unfairly. Sanctions restrict a country’s ability to fully participate in the global economy. Recent examples include the decision to use billions of dollars worth of Russia’s frozen assets for relief in Ukraine. In 2010, the G7 imposed an oil embargo, financial sanctions, and trade restrictions on Iran in response to its nuclear program. In 2006, sanctions were placed on North Korea to curb its nuclear ambitions. Sanctions were also imposed on Syria in 2011, targeting the Assad regime with asset freezes, travel bans, and trade restrictions due to the Syrian Civil War and human rights issues. Venezuela faced similar sanctions in 2017 amid its political and economic crisis.

The morality of these sanctions depends on one’s perspective and values. However, the imposition of sanctions and perceived injustices have driven the formation of economic teams. These alliances aim to create a new game that they believe will be fairer for them. This is the current world order, the players involved, and the stakes of the game. Ultimately, the grand prize they are all playing for is money.

The Real Prize: Control Over Money

In this context, “money” isn’t simply about cash, whether physical or digital. Countries can print more money at will. For this analysis, money equates to control—control over what money actually represents. A country’s money is its currency, and currency is an idea. Controlling and weakening a country’s currency can have significant consequences.

A weaker currency can lead to higher interest rates, making it more expensive for that country to borrow from other central banks. This, in turn, increases borrowing costs for consumers, affecting inflation. When a country’s currency is destabilized, it can alter public perception and confidence in that currency and, by extension, in the country itself. This loss of confidence can influence politics, elections, and even cause social unrest.

The current global contest is about controlling money as an idea. This struggle for control is why the term “dollarization” has become increasingly relevant in 2024.

Understanding Dollarization: Not a Conspiracy, but a Global Shift

Dollarization might sound ominous, akin to a conspiracy theory, but it doesn’t spell the end of the US dollar. Rather, it signifies a global trend towards reduced dependency on the dollar for international trade. This shift is not hypothetical—it’s happening and accelerating.

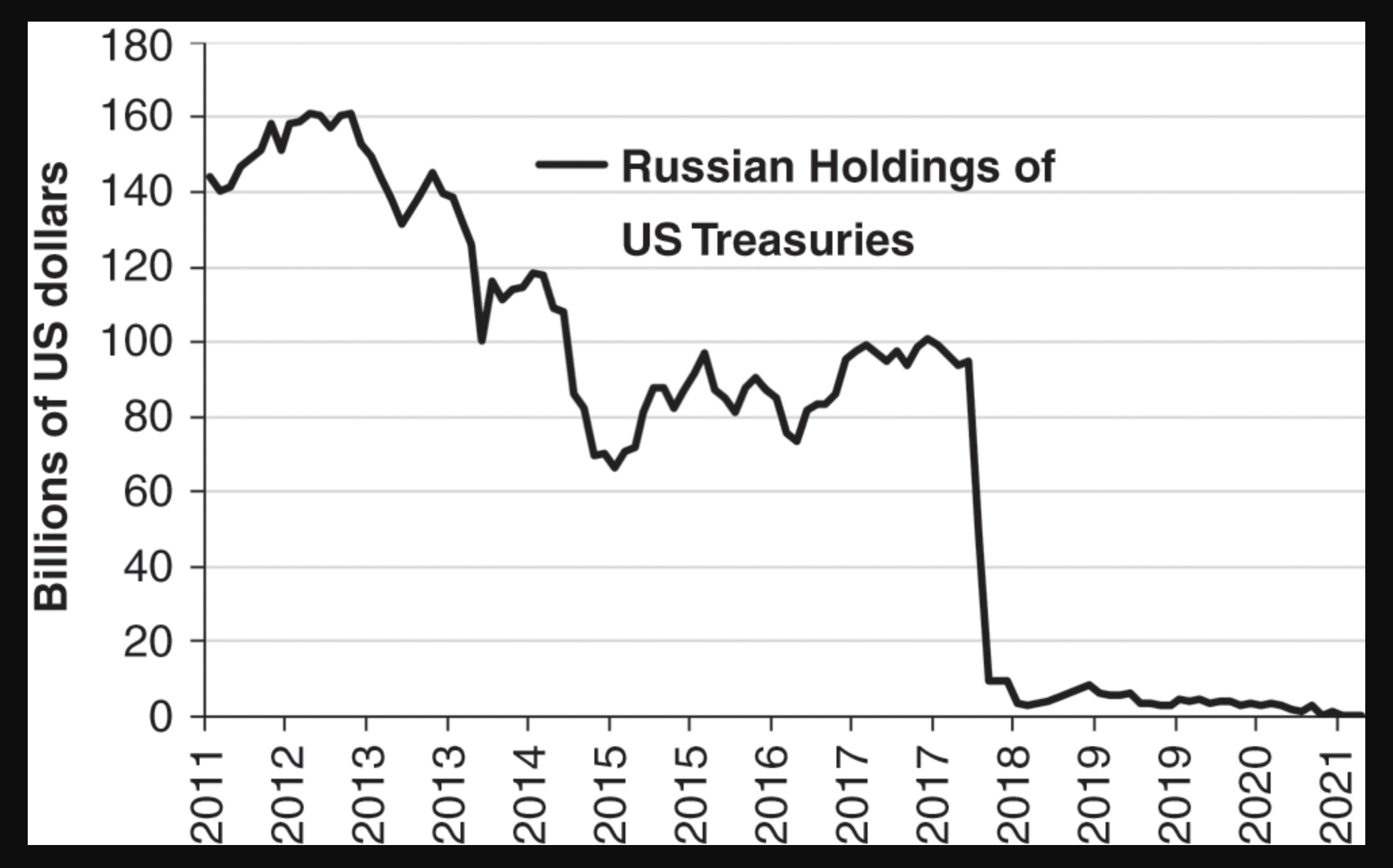

Recent developments illustrate this shift vividly. China has significantly reduced its holdings of US Treasury bonds. Saudi Arabia has also diminished its reliance on the dollar by joining China’s digital currency initiative, the Ember system—a move that the US views with skepticism, as it could undermine the dollar’s dominance.

In a historic move reflecting this trend, Russian President Vladimir Putin visited North Korea for the first time in 24 years. The visit aimed to establish a mutual defense pact, marking a strategic step away from the Petro-dollar system. Putin was warmly received by Kim Jong-un, a stark contrast to their countries’ isolated status in global diplomacy. Both Russia and North Korea, among the most sanctioned nations globally, seek to strengthen their positions by aligning strategically.

This alliance isn’t entirely new; echoes of it date back to 1961, during the era of the USSR. Although the Soviet Union collapsed in 1991, reshaping into modern-day Russia, the essence of this pact endures. The question remains: What drives these nations to forge such alliances?

Optimistically, some view this as a push towards a multipolar world, where power isn’t concentrated in a few nations. Conversely, pessimistic perspectives suggest Russia seeks military support amidst its contentious actions in Ukraine, while North Korea aims for technological advancements in exchange for strategic benefits like access to cheaper oil.

The recent public display of camaraderie between Kim Jong-un and Vladimir Putin, riding together in a limousine, symbolises this evolving geopolitical landscape — a landscape where alliances are forged, not just for mutual defense, but for reshaping global power dynamics.

Russia’s Shift Away from “Toxic Currencies” and Its Implications

Russia is actively distancing itself from what it considers “toxic currencies,” namely the US dollar and the Euro. The Moscow Exchange recently halted trading in US dollar and Euro pairs, restricting Russians from easily exchanging their rubles and assets into these currencies. Concurrently, Russia has forged a closer partnership with Vietnam, aiming to reduce dependency on the US dollar further.

Russian President Vladimir Putin’s strategic visits to both North Korea and Vietnam send a clear message to Western allies. Vietnam holds Russia as its highest-level comprehensive strategic partner after China, underscoring the growing alignment against Western economic dominance. Each step reinforces the trend towards dollarization, where nations seek alternatives to the US dollar.

The implications for the United States are concerning. A reduced influx of foreign funds can slow investment and potentially prolong inflationary pressures. Similarly, Russia’s abandonment of the US dollar undermines confidence in the ruble, discouraging its use and limiting currency exit options. This situation mirrors a highway with closed exits, forcing individuals to seek alternative routes — a scenario exacerbating economic instability.

Russia’s pivot towards China, making the yuan its default trading pair for the ruble, underscores this shift. However, this move primarily strengthens China’s economy rather than Russia’s, sparking concerns that the Chinese yuan could one day replace the US dollar as the global reserve currency. Yet, current global data shows the yuan trails far behind the dollar in global usage, with many global wealth managers favouring the stability of the dollar over the yuan.

In essence, Russia’s manoeuvres highlight a shifting global economic landscape where alliances and currency strategies reshape power dynamics. The outcome remains uncertain, yet the implications ripple through global markets, influencing economic strategies and geopolitical alliances worldwide.

Once a prominent member of the G8, Russia enjoyed a promising future among the world’s economic leaders. President Vladimir Putin maneuvered within this elite group, positioning Russia on a global stage alongside the strongest economies. However, driven by ambitions for power and influence, Putin’s regime accumulated vast wealth, arguably making him one of the wealthiest individuals globally—a status achieved at the expense of the Russian people.

In 2014, Russia’s annexation of Crimea led to its expulsion from the G8. Since then, Russia has faced significant economic challenges. While the US enjoyed historically low interest rates, Russia’s rates soared, reaching up to 72% at times, although even today they remain in the double digits. This stark disparity reflects global distrust in the ruble, hindering Russia’s ability to borrow at favorable rates and severely impacting its purchasing power on the international stage.

Comparatively, while the US grapples with an annual inflation rate of 3.4%, Russia contends with an 8% inflation rate, reminiscent of the US peak during the pandemic’s height. This economic strain underscores the hardship faced by the Russian populace, enduring prolonged inflationary pressures and economic instability. Unlike the US, Russia lacks a thriving global asset market, with no notable tech stocks or comparable opportunities for wealth preservation, exacerbating the challenges for its middle class.

The Future of the US Dollar and Global Reserve Currency Dynamics

There is ongoing discussion about the future trajectory of the US dollar amidst the phenomenon of dollarization, which is gradually gaining momentum. While this trend is observable, its pace remains relatively slow. Speculation persists regarding the potential emergence of another global reserve currency alongside the US dollar. Jerome Powell, Chairman of the Federal Reserve, has suggested the concept of two simultaneous global reserve currencies—a notion that raises significant interest and discussion among economic observers.

Historically, there have been periods where multiple major reserve currencies coexisted, suggesting a precedent for such a scenario. Additionally, the possibility of a central bank digital currency (CBDC) gaining prominence adds another layer of complexity to this evolving landscape.

For those interested in exploring further insights, resources are available to delve deeper into these developments. Notably, ongoing geopolitical events involving Russia and Ukraine are subjects of detailed analysis in videos provided by Jake, known for comprehensive research and presentation on these matters.

In parallel, ongoing coverage of global economic events remains a priority, supplemented occasionally by informative content on personal finance topics such as dividends, AI, and Bitcoin. The production of longer documentary-style videos continues to be a source of engagement and feedback. Reader feedback on these efforts is encouraged, with a commitment to providing valuable content.

As developments unfold, the dynamics of global reserve currencies and their implications for economic stability and growth will continue to be closely monitored and analysed.