Declining US Dollar: Economic Energy and Global Impact

The weakening US dollar, driven by factors like geopolitics and economic performance, impacts global economies, benefiting investors while challenging consumers, and may lead to lower interest rates to avoid a recession.

As the U.S. dollar begins to show signs of weakening, its implications are felt across the global economic landscape. The devaluation of the dollar is more than just a shift in currency value—it’s a phenomenon with deep-rooted consequences for economies, governments, investors, and everyday consumers. To truly grasp the gravity of this development, it is useful to draw a parallel between the behavior of the dollar and the fundamental principles of energy, as famously alluded to by Nikola Tesla. Tesla once remarked, “If you want to find the secrets of the universe, think in terms of energy, frequency, and vibration.” This perspective offers a profound analogy, suggesting that the movement of the dollar, much like energy, is subject to forces that cause its value to ebb and flow over time.

The Nature of Economic Energy

Energy, in its various forms—chemical, electrical, kinetic, thermal, nuclear, and solar—follows the second law of thermodynamics, where entropy inevitably leads to energy dissipation. Similarly, economic energy, which is stored in the form of money, also deteriorates over time due to various economic forces such as taxes, inflation, and the relentless printing of currency. Just as energy is converted and lost through different processes, economic energy too, dissipates with each transaction, losing its potency as it changes hands.

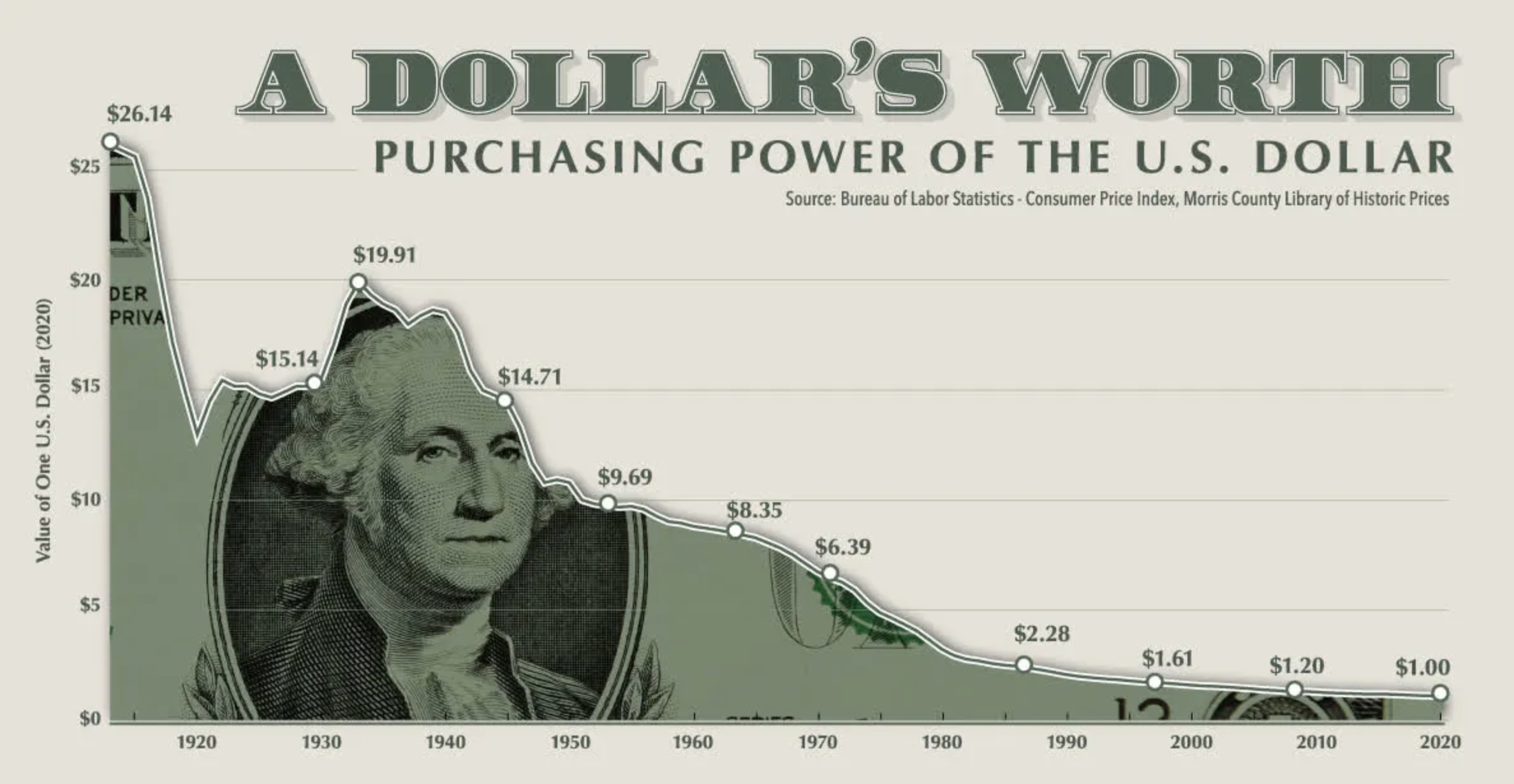

Over the last few years, the U.S. dollar has lost approximately 25% of its purchasing power. This depreciation means that what could be purchased with a dollar just a few years ago now requires significantly more dollars. This phenomenon has broad implications, affecting not just American consumers, but also the global economy, as the dollar has long been the world’s reserve currency. As global dynamics shift, the weakening of the dollar raises critical questions about the future of economic stability and the broader impacts on international trade.

Historical Context and Economic Consequences

To understand why the dollar fluctuates in value, it’s essential to consider the key factors that influence it: central bank interest rates, economic performance, inflation, and geopolitical events. For decades, the U.S. has maintained its position as the world’s economic leader, with the dollar serving as the cornerstone of global trade. However, in recent years, several countries have moved away from the dollar standard, opting instead to join alliances like BRICS (Brazil, Russia, India, China, and South Africa). Nations such as Iran, Malaysia, and Thailand have diversified their payment systems to reduce dependency on the U.S. dollar, a move that gradually erodes its global dominance.

As the dollar weakens, the cost of goods and services priced in dollars generally increases. This has a ripple effect across various sectors, particularly for those who rely on imports. For instance, between 2002 and 2008, the dollar’s value declined by around 40%, leading to a sharp increase in oil prices—from about $20 per barrel in 2002 to over $140 per barrel by mid-2008. This surge in oil prices had significant consequences for global economies, especially for nations heavily dependent on oil imports.

Who Benefits from a Weaker Dollar?

Despite the apparent drawbacks of a weaker dollar, there are certain scenarios where it can be advantageous, particularly for investors. When the dollar weakens, assets priced in foreign currencies become more valuable when converted back into dollars. This was evident in the early 2000s, when the dollar weakened against the Euro, allowing U.S. investors holding European stocks to see amplified returns.

Commodities also tend to benefit from a weaker dollar. Following the 2008 financial crisis, as the dollar’s value declined, gold prices soared from approximately $700 an ounce to nearly $1,900 by 2011. Similarly, Bitcoin, a digital commodity, often moves in the opposite direction of the dollar. As the dollar depreciates, it takes more dollars to purchase Bitcoin, driving up its price.

However, not everyone benefits from a weaker dollar. Consumers who do not invest or those who travel abroad may find themselves at a disadvantage. A weaker dollar makes imports more expensive, leading to higher prices for goods and services. Additionally, travel becomes costlier, as the dollar’s purchasing power diminishes in foreign markets.

The Role of Economic Policy in Dollar Valuation

The value of the U.S. dollar is also influenced by economic policy decisions. Historically, U.S. presidents have occasionally advocated for a weaker dollar to boost exports and stimulate the economy. For instance, in the 1970s, President Nixon took the U.S. off the gold standard, leading to a significant devaluation of the dollar. Similarly, President Ronald Reagan and President Donald Trump both pushed for policies that would weaken the dollar, arguing that it would make American products more competitive in global markets.

However, the long-term effects of these policies can be complex. While a weaker dollar may benefit exporters and certain investors, it can also lead to inflationary pressures, as imported goods become more expensive. This inflation can erode consumer purchasing power, leading to higher costs for everyday items.

The Impact of Interest Rates and Federal Reserve Policy

One of the primary tools used to influence the value of the dollar is the interest rate set by the Federal Reserve. When interest rates are high, they attract foreign investment into U.S. Treasury bonds, strengthening the dollar. Conversely, when interest rates are low, the dollar tends to weaken as investors seek higher returns elsewhere.

Currently, while much of the world is lowering interest rates to avoid recession, the U.S. has maintained relatively high rates. This policy has supported a stronger dollar, as global investors flock to the safety of U.S. assets. However, this trend may be shifting as the Federal Reserve faces pressure to lower interest rates in response to a slowing economy. Market predictions indicate that the Federal Reserve may cut rates, which could further weaken the dollar.

The Risks of Price Controls and Economic Intervention

In response to concerns about inflation and rising costs, some have proposed implementing price controls to prevent companies from raising prices too high. This idea, while seemingly appealing, has a troubled history. In 1971, President Nixon issued Executive Order 11615, which imposed a 90-day freeze on wages, prices, and rents. The goal was to curb inflation, but the result was economic chaos.

Price controls led to widespread shortages, as producers found it unprofitable to sell goods at artificially low prices. This scarcity prompted consumers to hoard goods, further exacerbating the problem. The shortages became so severe that a black market emerged, where goods were sold at inflated prices. The situation was a stark reminder that economic intervention can often have unintended consequences.

The lessons from the 1970s are still relevant today. Price controls, while well-intentioned, can distort markets and lead to greater economic instability. The U.S. dollar’s recent decline in response to even the suggestion of price controls is a testament to the market’s sensitivity to such policies.

The Future of the U.S. Dollar and Global Economic Stability

As the U.S. dollar continues to fluctuate, its future remains uncertain. The dollar’s value is a reflection of complex global dynamics, including geopolitical shifts, economic policy decisions, and market forces. While some may benefit from a weaker dollar, the broader implications for the global economy are far-reaching.

The ongoing devaluation of the dollar raises critical questions about economic stability and the future of global trade. As more countries move away from the dollar standard, the U.S. may find its economic influence waning. However, the dollar’s decline also presents opportunities for investors and policymakers to adapt to a changing economic landscape.

For those holding economic energy in the form of investments, a weaker dollar may offer opportunities for growth. However, for consumers and non-investors, the challenges are significant. Rising costs, inflation, and economic uncertainty all pose risks to financial stability.

In light of these challenges, it is essential to adopt a prudent approach to financial planning. Building a robust emergency fund, diversifying investments, and staying informed about economic trends are crucial steps in navigating this uncertain environment.

Navigating the Uncertain Future

The U.S. dollar’s weakening is more than just a financial headline; it is a complex issue with far-reaching implications. Understanding the dynamics at play—from the principles of economic energy to the impact of geopolitical shifts—is key to navigating the challenges ahead. As the global economy continues to evolve, so too will the role of the dollar, making it more important than ever for individuals and businesses to stay informed and prepared.

In the end, the decline of the dollar is a reminder of the interconnectedness of the global economy. As we move forward, the decisions made by policymakers, investors, and consumers will shape the future of not just the U.S. economy, but the world at large. Whether the dollar’s decline is seen as an opportunity or a challenge, one thing is certain: its impact will be felt by all.